In-Depth Evaluation of the Mint App

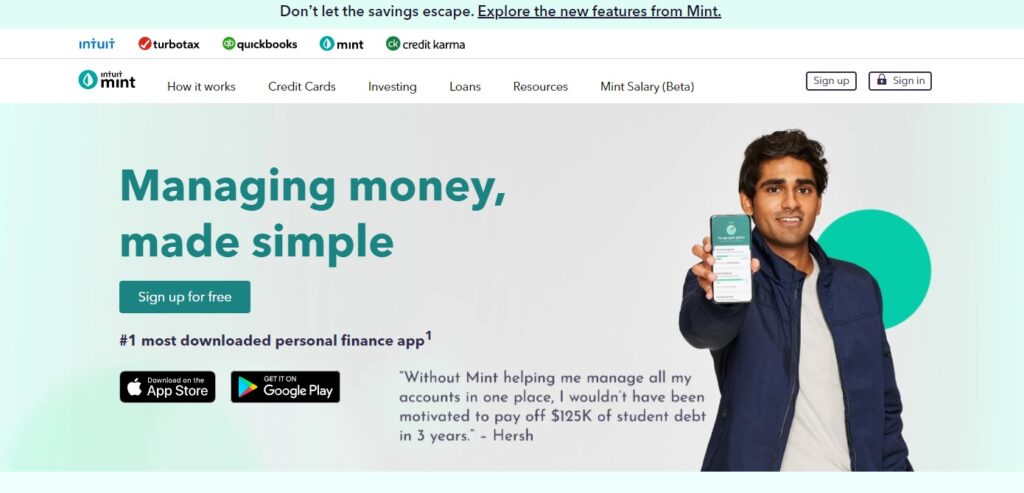

In-Depth Evaluation of the Mint App offers a comprehensive analysis of Mint, the renowned personal finance management tool. This page delves deep into its features, providing practical insights and expert tips to optimize your financial tracking experience. Whether you’re a novice exploring its functionalities or a seasoned user seeking advanced strategies, this resource aims to equip you with the knowledge needed to effectively manage your finances using Mint.

Discover detailed reviews, insightful analyses, and user-friendly tutorials on In-Depth Evaluation of the Mint App. From budgeting tools to investment tracking, each feature of Mint is thoroughly examined to help you make informed decisions and achieve your financial goals efficiently. Whether you’re looking to streamline your expenses or maximize savings, this page serves as your essential guide to leveraging the full potential of the Mint app.

Review of the Mint Budgeting Application

Accessing your online account on Mint.com is straightforward, but the Mint budgeting app offers convenient on-the-go access to transaction details and more. Compatible with both Apple and Android devices, including the iPhone, the Mint app ensures seamless functionality wherever you are.

Pricing of Mint App

Mint offers its services at no cost to users, making it accessible to all. When you create a free Mint account, you gain full access to its range of features. It’s important to note that Mint includes advertisements as part of its revenue model. Unlike some other apps, Mint does not offer a premium version that removes these ads. This ensures that everyone can benefit from Mint’s budgeting tools without any financial barriers.

Advantages of Mint Budgeting App

The Mint budgeting app offers several distinct advantages to help users manage their finances effectively. By consolidating financial accounts into one platform, Mint provides a comprehensive overview of spending patterns, allowing users to track expenses effortlessly. Moreover, its intuitive interface simplifies budget creation and management, making it accessible for both seasoned budgeters and beginners alike. With automated categorization and bill reminders, Mint empowers users to stay organized and proactive in achieving their financial goals.

Consolidate Your Financial Accounts Easily

Mint makes it simple to connect all your financial accounts in one place. Whether it’s bank accounts, credit cards, personal loans, or your mortgage, Mint supports a wide range of account types. By linking everything to the Mint budgeting app, you gain a comprehensive view of your income and debts from a single platform.

Track Your Spending and Receive Alerts

With Mint, monitoring your daily spending is effortless. Keep tabs on account balances and recent transactions to stay informed about your financial health and net worth.

Avoid missed payments or overspending with Mint’s budgeting tools. Customize alerts for various events such as low balances, bill payments, late fees, and exceeding budget limits within specific categories. You can also receive notifications about rate changes, unusual account activities, and more.

Monitor and Manage Investments

Despite being primarily a budgeting app, Mint offers insights into your investments as well. Easily view details from your investment accounts like IRAs, 401ks, and brokerage accounts. Compare your portfolio performance against industry benchmarks and keep track of fees using Mint’s investment tracking features.

Set Financial Goals and Monitor Credit Scores

Achieve your financial milestones by setting and tracking goals within Mint. Whether it’s paying off debt, building savings, or improving your credit score, Mint helps you stay on track.

Monitor your credit score with confidence using Mint’s free credit monitoring tools. Conduct soft credit checks to view your TransUnion Vantage Score and receive valuable insights into how your score is calculated. Plus, get personalized tips to boost your credit score without impacting it negatively.

Ensure Maximum Security

With Intuit backing Mint, rest assured your data is secure. Intuit adheres to the highest security standards, employing advanced encryption methods and trusted protocols like VeriSign for secure data transmission. Safeguard your account further with features like multi-factor authentication and optional mobile device security codes. In case of emergencies, remotely manage your mobile access or delete your account from any computer.

Disadvantages of Mint Budgeting App

While the Mint budgeting app offers robust financial tracking features, it comes with notable disadvantages. Users often report concerns regarding data security and privacy, as Mint requires access to personal financial accounts. Additionally, its categorization algorithm can be inaccurate, leading to mismanaged budgets and frustration among users aiming for precise financial planning.

Time-Consuming Initial Setup

Setting up Mint requires creating a comprehensive account and linking all necessary financial accounts. Depending on the number of accounts you manage, entering all relevant information can be a time-consuming process. Additionally, familiarizing yourself with Mint’s functionalities may also require some initial investment of time to maximize its benefits.

Inaccurate Automatic Categorization

Although Mint offers automatic categorization of expenses, it isn’t always flawless. Occasionally, the app may assign expenses incorrectly, necessitating manual adjustments by the user. This can involve editing categories to ensure accurate budget tracking and financial analysis.

Challenges with Account Connections

Some users have reported intermittent difficulties in connecting their financial accounts to Mint. These issues may particularly affect connections with certain financial institutions or smaller banks, making it challenging to fully integrate all accounts into the app’s interface.

Persistent Promotion of Financial Products

While Mint itself is free to use, it generates revenue through partnerships with financial institutions, which results in frequent advertisements for various financial products within the app. These advertisements appear regularly as users navigate through Mint’s features. While this model allows Mint to remain free for users, some individuals find the constant promotional content intrusive.

Other Options Besides Mint App

Exploring alternative options to Mint App provides users with a range of diverse financial management tools that cater to varying needs and preferences. Whether seeking enhanced budgeting features, more intuitive interfaces, or specialized financial insights, these alternatives offer unique solutions to effectively manage personal finances.

You Need A Budget (YNAB)

Offers a meticulous approach to budgeting through its ‘zero-based budgeting system’. Unlike traditional methods where funds are allocated into various categories, YNAB requires users to assign every dollar they earn a specific purpose. This method not only ensures thorough financial tracking but also encourages better budgeting practices through its educational tools, allowing users to plan ahead for future months and refine their budgeting skills.

However, potential users should be aware that YNAB operates on a subscription basis, requiring monthly or annual fees.

Zeta

Specializes in budget management tailored for couples. It simplifies budgeting by enabling users to allocate and divide expenses between shared and individual categories effortlessly. Additionally, Zeta provides comprehensive insights into total income, expenses, and includes features like bill reminders.

Nevertheless, Zeta may not fully meet the needs of individuals seeking a personal budgeting solution.

Frequently Asked Questions

As part of our comprehensive evaluation of the Mint app, we’ve compiled answers to common inquiries users may have. Whether you’re curious about Mint’s security measures, its compatibility with various devices, or its unique features for budgeting and financial tracking, this FAQ section aims to provide clarity and insights into what makes Mint a popular choice among personal finance management tools.

What are the key features of the Mint app?

The Mint app offers comprehensive financial management tools, including budget tracking, bill reminders, and credit score monitoring. It aggregates all financial accounts in one place, providing insights into spending patterns and personalized budget recommendations. Users can set financial goals and receive alerts for unusual account activities, making it a versatile tool for managing personal finances effectively.

How secure is the Mint app with sensitive financial information?

Mint prioritizes security with 256-bit encryption and regular security scanning. It uses multi-factor authentication to protect user accounts and employs bank-level security protocols to ensure the confidentiality of financial data. Additionally, Mint does not store banking credentials on the user’s device, further enhancing security measures to safeguard sensitive information.

Can Mint sync with multiple financial accounts from different institutions?

Yes, Mint supports synchronization with various financial institutions, including banks, credit cards, investment accounts, and loans. Users can link accounts seamlessly to track transactions and balances automatically. This feature allows for a holistic view of financial health without the need to manually update information across multiple platforms, streamlining the management of diverse financial portfolios.

How accurate are Mint’s budgeting and spending categorizations?

Mint uses algorithms to categorize transactions based on merchant information and spending patterns. While it generally provides accurate categorizations, users have the flexibility to adjust and customize categories as needed. Regular updates and refinements to the categorization system improve accuracy over time, ensuring that budgeting insights are reflective of actual spending habits and financial goals.

Does Mint provide educational resources for financial planning and management?

Yes, Mint offers educational content and tools to help users improve their financial literacy and make informed decisions. These resources include articles, guides, and tips on budgeting, saving, investing, and managing debt. The app also features personalized advice based on user financial data, empowering individuals to achieve financial wellness through actionable insights and expert recommendations.