Analysis of ProConnect Tax Online

ProConnect Tax Online, developed by Glance Intuit and accessible via the cloud, is specialized software designed for tax professionals. It offers a comprehensive range of over 5,700 forms for both individual and business tax filings, encompassing forms such as 1040, 1041, 1065, 1120, 1120s, 709, and 990. Unlike many other tax software options that are tailored for simpler tax situations, ProConnect Tax is equipped with advanced capabilities including thousands of critical diagnostics, automated calculations, and tailored suggestions. This ensures that tax professionals can efficiently manage complex tax scenarios, minimizing the risk of missing deductions or encountering e-file rejections.

Focused on professionals, ProConnect Tax Online provides comprehensive support for various tax scenarios. It features customizable templates, automated calculations, and secure data handling. This review aims to optimize tax preparation workflows, ensuring precision and efficiency throughout the tax season.

Advantages of ProConnect Tax

ProConnect Tax stands out for its comprehensive suite of tools that enhance tax preparation efficiency and accuracy. Its intuitive interface makes navigating complex tax filings straightforward, catering to both individual and business needs. With secure data handling and seamless integration capabilities, it’s a trusted choice for professionals seeking reliable tax software solutions.

Software for Managing Taxes in the Cloud

ProConnect Tax offers robust cloud-based software designed for efficient tax management across businesses of all sizes. This platform integrates essential functionalities such as payment management, document handling, electronic filing, and more within a unified portal. It facilitates seamless collaboration by enabling organizations and large enterprises to create, share, and manage documents with both internal teams and external stakeholders. Furthermore, ProConnect Tax supports easy integration with QuickBooks, enhancing its utility and compatibility with existing accounting systems.

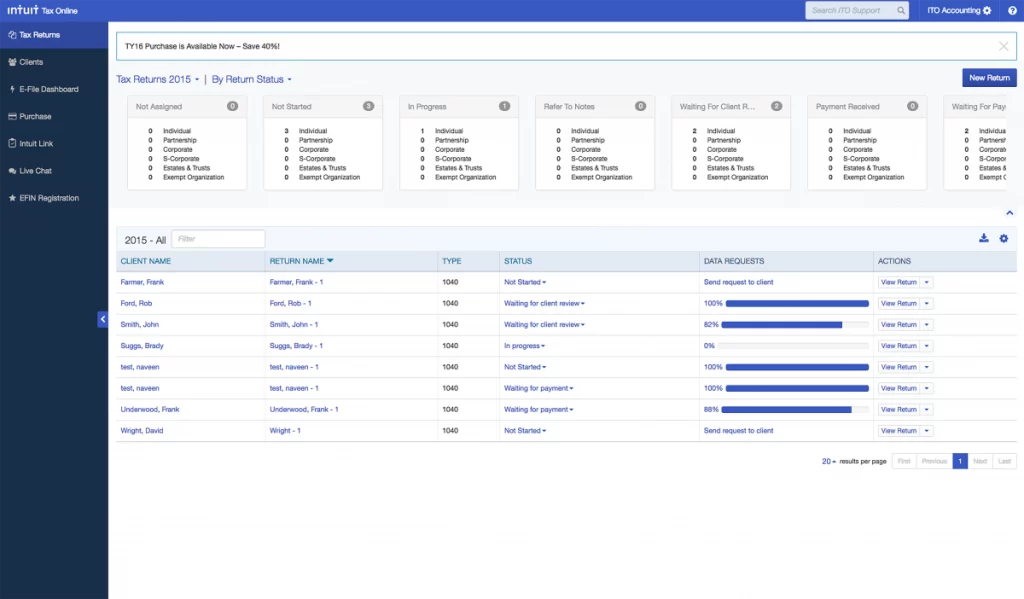

The Inuit Link

The Inuit Link feature enhances workflow efficiency by allowing users, including tax attorneys, to promptly identify files with missing data. This capability minimizes review times by addressing gaps well before the filing stage. This feature utilizes a secure online portal to streamline the collection of client documents, enabling centralized organization and easy retrieval based on client-specific categorization. Automated data entry and document collection further optimize operational efficiency within the platform.

Integrated Tax Planning Tool

A standout feature of ProConnect Tax is its built-in Tax Planner, empowering users to develop comparative scenarios and analyze historical data to assess tax liabilities comprehensively. Users can generate and export detailed tax summaries in PDF format, facilitating seamless reporting and compliance. The platform also offers additional tools such as streamlined data entry, integration with third-party applications, document management, and comprehensive review capabilities.

Disadvantages of ProConnect Tax

Despite its efficiency, ProConnect Tax Online may pose challenges with its learning curve for new users. Additionally, its pricing structure could be prohibitive for smaller firms. Furthermore, reliance on internet connectivity may affect accessibility in remote areas.

Inexperienced software personnel

Issues related to software can arise, often compounded by user dissatisfaction with the support provided. Enhancing training in tax law and basic return preparation for software support personnel could significantly improve the quality and effectiveness of their service.

Cost per Tax Return

The flat-rate fees for tax returns per individual can present a significant barrier depending on the scale of your business operations. While ProConnect offers promotional rates initially, the transition to standard rates can pose challenges for smaller businesses, as these rates can be double or triple the initial cost, making them less affordable and competitive in the long term.

ProConnect Tax Online Pricing

ProConnect Tax provides a risk-free trial period allowing you to explore our comprehensive tax software without the need for an upfront credit card. During the trial, you’ll experience the full functionality of our software, not just a limited demo version. To get started, simply create an account and answer a few questions to receive personalized service, unless you are already an existing Intuit customer.

Our pricing structure is straightforward with a single flat rate per tax return, ensuring you only pay for the services you use. Below are the current rates for various types of returns, which include e-filing for state, federal, multi-state, and municipal returns. Please note that these prices may be subject to promotional offers:

1040 Individual Returns

- 1-9 Returns: $66.47 per return

- 10-49 Returns: $58.77 per return

- 50-99 Returns: $51.77 per return

- 100-199 Returns: $40.57 per return

- 200-299 Returns: $33.57 per return

- 300+ Returns: Please contact customer service

1041, 1065, 1120, 1120s, 990 Business Returns

- 1-9 Returns: $82.57 per return

- 10-49 Returns: $73.47 per return

- 50-99 Returns: $64.37 per return

- 100-199 Returns: $50.37 per return

- 200-299 Returns: $41.97 per return

- 300+ Returns: Please contact customer service

Other Options Besides ProConnect Tax

Explore additional tax preparation solutions that offer competitive features and pricing structures to suit your needs. Each alternative provides unique benefits that may cater to different business sizes or specific tax requirements. Compare these options to find the best fit for your tax preparation needs.

TaxJar

Price TaxJar offers three subscription plans ranging from $19 to $99+ per month.

Pros TaxJar specializes in meeting the tax requirements of eCommerce businesses, providing robust support and a user-friendly interface.

Cons It may not be suitable for freelancers or businesses outside of eCommerce due to its specific focus on sales tax management.

Avalara

Price Avalara’s pricing starts at $19 per month for basic returns, with standard returns and calculations available from $83 per month. Custom packages are also offered.

Pros Avalara provides a free trial and is well-suited for mid-market businesses looking for comprehensive tax solutions.

Cons While there is a free trial option, overall pricing tends to be higher compared to other providers.

Canopy

Price Canopy’s pricing structure varies by feature. For instance, time and billing services are priced at $24 per month per user, document management at $40 per month per user, and workflow and tax solutions at $30 and $33 per month respectively.

Pros Canopy excels in managing complex tax scenarios.

Cons There’s no free trial available, and some users have reported connectivity issues with email tracking, as well as restrictions related to electronic signatures and other minor operational details.

Frequently Asked Questions

Welcome to our comprehensive FAQ section on ProConnect Tax Online! Explore answers to common queries about features, pricing, and troubleshooting to maximize your tax preparation experience.

What are the key features of ProConnect Tax Online?

ProConnect Tax Online is a robust tax preparation software designed for tax professionals. It offers comprehensive features such as automatic calculations, e-filing options, and access to a wide range of IRS forms and schedules. Its cloud-based platform allows for anytime, anywhere access and collaboration among team members. Additionally, the software provides real-time updates on tax law changes, ensuring users remain compliant and informed throughout the tax season.

How secure is ProConnect Tax Online for handling sensitive client data?

ProConnect Tax Online prioritizes security with advanced encryption protocols and secure data centers. The software complies with industry standards and regulations to protect sensitive client information, including Social Security numbers and financial details. Users can control access permissions and utilize multi-factor authentication for added security. Regular audits and updates further ensure that the platform meets the highest standards of data protection.

Can ProConnect Tax Online integrate with other accounting software and tools?

Yes, ProConnect Tax Online offers seamless integration with various accounting software and productivity tools commonly used by tax professionals. This includes popular applications for bookkeeping, payroll management, and client communication. Integration streamlines workflows, reduces data entry errors, and enhances overall efficiency during tax preparation and filing processes.

How does ProConnect Tax Online support collaboration among tax professionals?

ProConnect Tax Online facilitates collaboration through its cloud-based platform, enabling multiple users to work on the same client file simultaneously. Users can assign tasks, leave comments, and track changes in real-time, enhancing teamwork and productivity. The software also includes features for securely sharing documents with clients and receiving their electronic signatures, streamlining the entire tax preparation process.

What customer support options are available with ProConnect Tax Online?

ProConnect Tax Online provides comprehensive customer support to assist users with any questions or issues they encounter. Support options include phone assistance, live chat with knowledgeable agents, and an extensive knowledge base with tutorials and FAQs. Additionally, users have access to webinars and training resources to deepen their understanding of the software’s functionalities and maximize its capabilities during tax season.