The Definitive Review of TurboTax Online

Since its inception in 1993, Inuit has been a prominent provider of financial management solutions tailored for entrepreneurs, freelancers, independent contractors, as well as small and mid-sized companies. One of their flagship offerings, TurboTax, has established itself as a widely-used software for personal tax preparation, especially convenient for online filing. TurboTax provides various packages, including a free option, ensuring accurate preparation and filing of federal and state income tax returns.

The Definitive Review of TurboTax Online offers a thorough examination of TurboTax’s online tax preparation software, providing detailed insights into its features, usability, and effectiveness. Whether you’re a novice taxpayer or an experienced filer, discover all you need to know to navigate tax season efficiently and effectively.

Review of TurboTax Tax Preparation Software

In the ever-evolving landscape of tax preparation software, TurboTax stands out as a leading solution, renowned for its user-friendly interface and comprehensive features. Offering a range of packages tailored to various tax scenarios, TurboTax simplifies the filing process for individuals and businesses alike. From seamless navigation to robust support options, it continues to be a top choice for taxpayers seeking efficiency and accuracy in managing their finances.

Advantages of TurboTax

TurboTax offers a multitude of advantages that streamline the tax-filing process for individuals and businesses alike. Its user-friendly interface simplifies complex tax codes, ensuring accuracy and efficiency. By providing step-by-step guidance and automated calculations, TurboTax minimizes errors and maximizes refunds, making it a preferred choice for tax preparation year after year.

User-Friendly

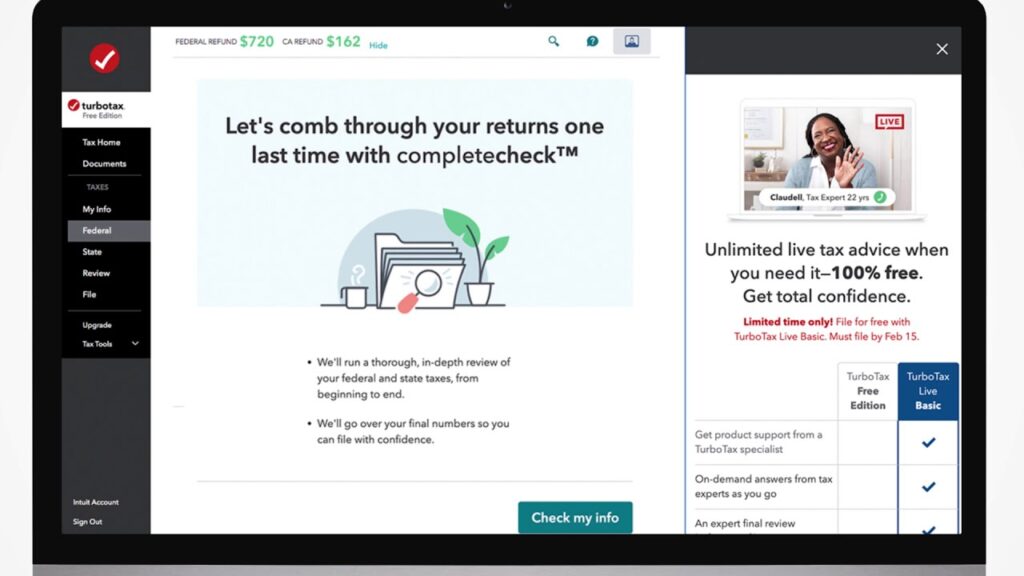

TurboTax provides a user-friendly experience with a streamlined interface that allows you to navigate effortlessly. A progress banner keeps you informed about what sections you’ve completed and what still needs attention. Embedded links, help buttons, and on-screen chat support are readily accessible, ensuring you have multiple resources at your fingertips while using TurboTax.

One notable feature across various TurboTax plans (including Deluxe, Premier, and Self-Employed) is ItsDeductible, which helps you quickly assess the value of donated items like household goods and clothing for tax deductions.

Bring in Different Tax Documents

Importing tax documents is straightforward with TurboTax. If your employer is partnered with TurboTax, your tax information can be imported automatically. Alternatively, you can photograph your W2 or upload specific 1099 forms directly to your TurboTax account. For Self-Employed users, taking photos of client 1099-NEC forms is also supported. Moreover, TurboTax enables the importation of electronic PDFs of previous tax returns from other providers like H&R Block, TaxAct, or TaxSlayer. Crypto investors benefit from the ability to import up to 4,000 transactions simultaneously with the Premier plan.

Beneficial Support Choices

TurboTax offers extensive support options. In addition to searchable forums and video tutorials on their website, a 24/7 chatbot provides technical assistance. All paid packages include access to tax specialists for personalized support. Live, on-screen tax advice is also available, ensuring you get expert guidance when needed.

For those seeking a more hands-off approach, TurboTax Live includes a one-on-one tax review with a professional before filing your return. Throughout the year, TurboTax Live users have unlimited access to tax advice via one-way video sessions. Additionally, the Live Full Service option allows you to meet with a tax preparer via video call for a comprehensive tax preparation experience, from initial consultation to final review of your tax return.

Disadvantages of TurboTax

While TurboTax offers convenience in tax preparation, it comes with notable disadvantages. Users often face high costs for certain features and may encounter limitations in complex tax situations. Additionally, relying solely on software can result in missed opportunities for personalized tax advice and guidance.

Expense of TurboTax software

TurboTax presents itself as a convenient tool for tax preparation, but users should be aware of its potential drawbacks. While there is a free version available, additional services such as state filing can incur substantial costs. Moreover, seeking assistance from live tax experts or opting for them to file on your behalf comes with added fees. Furthermore, utilizing TurboTax to deduct your tax preparation fees from your refund also results in processing fees. These expenses can accumulate rapidly, making TurboTax a costly choice, especially for individuals with complex tax situations who may benefit from more personalized tax advice and guidance.

What is the pricing of TurboTax

TurboTax offers both free and paid packages. Each plan includes features such as access to live consultations with tax experts and a thorough review available until March 31st.

TurboTax offers a free version that allows you to file simple tax returns using Form 1040 and your state return. However, it does not support itemizing deductions or filing various schedules (1, 2, or 3) of Form 1040.

For more complex tax situations, TurboTax provides three paid packages

- Deluxe: Priced at $59, plus $49 per state. Deluxe Live is available for $119, plus $54. This package allows you to itemize deductions, claim tax deductions, and organize and claim credits.

- Premier: Costs $89, plus $49 per state. Premier Live is priced at $169, plus $54. In addition to all features of Deluxe, Premier includes investment reporting, rental income reporting, and supports Schedule D (capital gains and losses), Schedule E (rental real estate and partnership income), and K-1s (income from partnerships).

- Self-Employed: Priced at $119, plus $49 per state. Self-Employed Live costs $199, plus $54. This package builds on Premier by offering features for business income and expenses (Schedule C), home office deductions, and tools for freelancers.

Other Options Besides TurboTax

Other Options Besides TurboTax offer a variety of alternatives for tax preparation, catering to different preferences and needs. These options encompass user-friendly interfaces, specialized features for complex tax situations, and competitive pricing models. Whether seeking simplicity, robust functionality, or cost-efficiency, exploring these alternatives ensures finding the right fit for managing taxes effectively.

TaxSlayer

TaxSlayer offers a range of pricing options depending on the complexity of your tax needs, starting at $29.95 for federal returns and ranging up to $59.95. State filing fees vary from $0 to $39.95 per state. They also provide a free plan tailored for straightforward tax returns.

Pros of TaxSlayer include its flexibility with four distinct plans catering to different business requirements.

However, TaxSlayer’s accessibility to on-demand assistance from tax professionals is limited to higher-tier packages like Premium and Self-Employed. Users have noted that its interface may not be as user-friendly as some competitors’.

TaxAct

TaxAct, on the other hand, offers federal filing prices ranging from $46.95 to $94.95, with state filing costs between $39.95 and $54.95. It also features a free version suitable for simple tax returns.

Advantage of TaxAct is its absence of a base fee, unlike TurboTax which starts at $49. TaxAct provides a mobile app and offers free assistance through Xpert Assist.

However, TaxAct’s overall cost for state and federal filings tends to be higher despite the lack of a base fee. Additionally, it lacks an offline version, and some users have reported difficulties navigating through resource links, which can detract from the user experience.

Frequently Asked Question

Navigating tax software like TurboTax Online can be daunting without clear guidance. This review aims to provide a comprehensive overview of TurboTax Online, addressing common queries to help you make an informed decision. Whether you’re a first-time user or seeking detailed insights, this guide covers essential aspects of TurboTax’s features, usability, and overall effectiveness.

What are the key features of TurboTax Online that make it stand out for taxpayers?

TurboTax Online offers a comprehensive suite of features designed to simplify tax filing. It provides step-by-step guidance tailored to individual tax situations, ensuring accuracy and maximizing deductions. Users can import W-2 forms directly from employers and upload previous year’s tax returns effortlessly. The platform also includes a robust error-checking system to identify potential mistakes before filing. Additionally, TurboTax Online offers real-time support from tax experts, providing peace of mind and ensuring users can file confidently and securely from start to finish.

How secure is TurboTax Online for handling sensitive personal and financial information?

TurboTax Online employs industry-leading security measures to protect users’ data. It utilizes encryption protocols to safeguard personal and financial information during transmission and storage. The platform adheres to strict privacy policies and compliance standards, ensuring that user data is protected from unauthorized access. TurboTax also offers multi-factor authentication options for added security. With continuous monitoring and updates to its security infrastructure, TurboTax Online provides a secure environment for taxpayers to file their taxes online with confidence.

Can TurboTax Online handle complex tax situations, such as investments or rental properties?

Yes, TurboTax Online is equipped to handle a wide range of tax situations, including investments and rental properties. The platform guides users through reporting income, deductions, and expenses associated with investments or rental properties with ease. It offers specific forms and schedules tailored to these situations, ensuring accurate reporting and maximizing deductions. TurboTax Online also provides explanations and tips relevant to each situation, empowering users to navigate complex tax scenarios confidently and efficiently.

How does TurboTax Online compare to other tax preparation software in terms of user-friendliness?

TurboTax Online is renowned for its user-friendly interface and intuitive navigation. The platform provides clear instructions and prompts at every step of the filing process, making it accessible for both first-time users and experienced filers. It offers a seamless experience with features like automatic data import and error-checking, minimizing the time and effort required to complete taxes. TurboTax Online also provides access to a comprehensive knowledge base and customer support options, ensuring users can resolve any queries or issues quickly and efficiently.

What customer support options are available with TurboTax Online, and how responsive are they?

TurboTax Online offers multiple customer support options to assist users throughout the tax filing process. Users can access live chat support with tax experts who provide personalized guidance and answers to specific tax questions. The platform also offers phone support for more complex inquiries or technical issues. Additionally, TurboTax Online features an extensive library of FAQs, articles, and video tutorials covering a wide range of topics related to tax preparation. With these support options, TurboTax Online ensures that users receive timely assistance and can resolve any issues they encounter while filing their taxes online.